Content

To look up current federal wage determinations by trade and county, see SAM.gov Wage Determinations. While you’re gaining experience with the reporting process bid for city projects and build yourself up to state and federal work. Some states and cities will have different names for their reporting agency. Once you win a job — before the work even starts — find out the name of the reporting office and request a list of their requirements. Taxes & Deductions — An employee’s tax withholdings and deductions taken out of the prevailing wage earnings. Keep in mind certified payroll has evolved alongside technological advances.

- Contributions and payments made on behalf of the employee are also reflected on the A-1-131, unlike the WH-347.

- Nine possible wage decisions, and the applicable decisions will be included in the contract.

- Complying with the Davis-Bacon Act also protects you from penalties and fines.

- With expertise that covers the full range of employment and labor law, Van Goodwin routinely defends employers in complex employment litigation in both state and federal courts, as well as in agency proceedings before the U.

- You’ll be glad you did if you ever need to refer back to them.

The Prevailing Wage Rate Determinations list wage and fringe benefit rates based on collective bargaining agreements established for a particular craft or trade on the locality in which the public work is performed. In New Jersey, rates vary by county and statewide and by the type of work performed. Prevailing wage rates are wage rates based on the collective bargaining agreements established for a particular craft or trade in the locality in which the public work is performed.

Certified Payroll Report retention

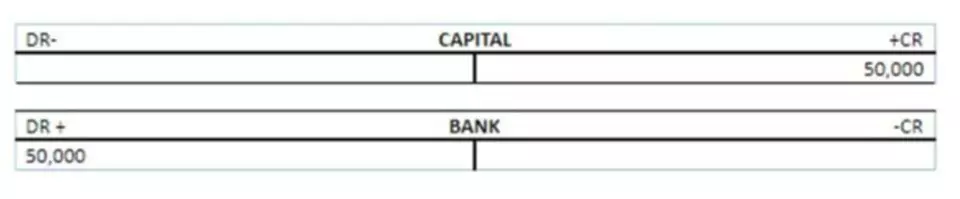

certified payroll contracts require certified payroll reporting for you, however. A certified payroll report is an accounting of everything you paid your employees while working on a contract for a government client. Tracking Form is a tool prime contractor shall utilize a payroll to ensure that all subcontractors have submitted certified payroll reports.

But by having these specific details accessible, the process of filing certified payroll can run more efficiently. Hours — The hours an employee worked that week and a complete break down of the pay rates for those hours . No matter what, the prevailing wage has to be met in some capacity. Contractors usually don’t have a choice in the matter — it all depends on what the contract of the prevailing wage job permits. If a contractor has a choice, then the best option will depend on company circumstances like the size of the work force or the bandwidth of the budget. Whether your construction company is focused on adding more employees, working with new unions or taking on more jobs – HCM TradeSeal helps you focus on growth. Combined with Paychex’s reliable HR and payroll technology, HCM TradeSeal connects your systems together to produce a seamless payroll, costing and reporting cycle.

Who Needs to File Certified Payroll Reports?

They have the knowledge and experience to handle all types of payroll processes, including certified payroll. Certified payroll is mandatory for contractors and subcontractors who work on various types of federally funded construction contracts that are over $2,000.

The contractor is paying their workers the correct prevailing wage — as outlined by their contract. Agencies may require extra steps when it comes to reporting mandated information.

The Importance of Being Certified Payroll Compliant

Prevailing wage is the minimum amount an employer can pay their laborers while they work a government-funded job. The Davis-Bacon Act requires interviews to determine if the contractor is complying with the Federal Davis-Bacon prevailing wages.

Even during economic turmoil, there will still be federal money given to states and cities for different endeavors. Having a strong record of compliance can give construction companies a competitive edge during bidding. Continue to utilize Acumatica’s powerful capabilities, while shifting HR and payroll management to Paychex. Use Paychex Flex as your external HR and payroll system, while maintaining detailed job cost information in NetSuite. Use Paychex as an external HR and payroll system, while continuing to use JD Edwards’ powerful enterprise management features. Take advantage of Procore’s powerful project management capabilities, while managing HR and payroll with Paychex Flex. HCM TradeSeal and Paychex Flex users can enjoy seamless connectivity with construction’s most popular ERP systems.